The Investment

-

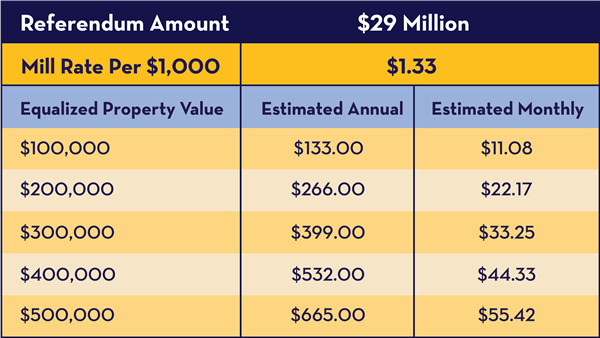

Assumptions: Two 20-year borrowings amortized using planning interest rates of 4.75%. Mill rate based on the 2023 Equalized Valuation (TID-OUT) of $1,399,321,480 with annual growth of 14.00% in 2024 & 1.00% thereafter. Assumed Maximum Annual Aid Loss (Hold-Harmless): $243,525 Tertiary Aid Impact (2023-24 October 15 Certification): -84.62%. * Represents an estimate of the maximum projected annual mill rate for referendum approved debt service. Note: Planning estimates only. Significant changes in market conditions will require adjustments to current financing plan.

Tax Impact Calculator

Directions: Enter your Fair Market Value (no commas, ex. 150000) and click on Calculate to see your tax estimates.